TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published.

I suspect that most people reading this blog are savvy enough to know that you should never just assume that the charges on your credit card are correct – banks have become very good at detecting fraud but things still slip through the net all the time and you never know when you’re scheduled to be someone’s victim. Sadly fraud is a fact of life but we know about it so we can look out for it when our statements come in….and most people do just that. But most people only do that. They don’t check anything else.

If you’re participating in the miles and points game/hobby/obsession (whatever you like to call it) than you should already know to treat your miles and points like currencies. They have inherent value and are therefore, in many ways, not that different from money – you can, after all, buy an incredible amount of things with miles and points….and those things are not limited to flights and hotel rooms.

You can shop on Amazon with your points you can buy gift cards with your points and you can buy all sorts of things from shopping portals set up by the credit card companies and hotel chains with your points (you really shouldn’t…but you can). And yet there are a lot of people out there who don’t pay enough attention to how many miles and points they should actually have.

You can use services like Award Wallet to monitor your various balances but, while that’s fantastic for keeping track of the miles and points you already have, what about the miles and points you should have earned?

Most people are at least vaguely aware that loyalty accounts can be hacked and balances emptied and services like Award Wallet can help users spot things like that almost as soon as they happen – but there aren’t any services that track what miles and points are due to you from the various loyalty programs and credit card companies.

This is where I think a lot of people could be bleeding points.

Take a recent experience of mine as an example.

I had a stay at the Courtyard Marriott in Seoul and I used my Chase Marriott Visa to pay for my room:

As I only use this credit card for Marriott spend and as this was a particularly quiet month for Marriott stays for me, it turned out that this charge was the only charge on the whole statement.

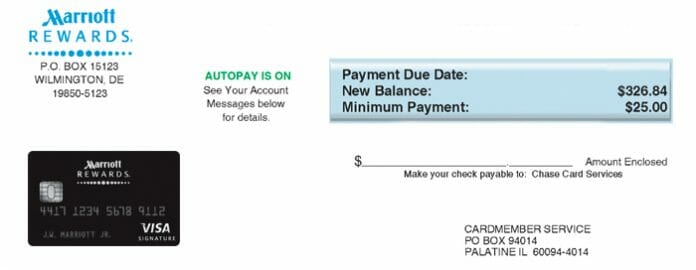

Here’s my statement summary showing the grand total of $326.84 as my spending from the month….

……and here’s the specific line item in detailed part of my statement:

The issue here is that the description of the transaction clearly loses something in translation (if I didn’t know what that was I would never guess) and nowhere is the name “Marriott” or “Courtyard” mentioned anywhere.

And this clearly caused issues for Chase because when I checked to see how many Marriott Rewards points I had earned on this statement it wasn’t what I had been expecting:

Chase had awarded me 1 point/$ spend on my Marriott Visa card when spend at Marriott properties should earn 5 times that.

I was expecting 1,635 points but I was only credited with 327

Luckily I find Chase to be a very easy bank to deal with and I used their online secure messaging system to point out the issue.

Within an hour I had a response:

Hello Ziggy,

We will be glad to assist you with the additional points for your transaction on the Marriott Premier® Credit Card

I would request you to please provide a receipt for your transaction at Marriott Courtyard in South Korea as an attachment with your email. Once we receive your response, we will review further and assist you accordingly.

That was a simple enough request so I fired off another message with my folio attached.

A further hour later the issue had been dealt with:

Hello Ziggy,

I am writing in response to your inquiry about the charge on your Marriott Rewards® Credit Card account.

We researched the purchase made at Sangsangseutei(Joo)Koteuyin the amount of $326.84 on xx/xx/xx.

Here’s how we have resolved the situation:

We can confirm that this transaction is categorized as a Marriott property, and therefore does qualify to receive the 5 Marriott points per $1. Hence, we’ve added the 1308 points (remaining 4 points per $1.00) to your account. You will see this adjustment on your next billing statement.

Thank you Chase.

Here’s The Thing….

Clearly this is a nearly insignificant number of points that I was nearly not credited with….but that’s not the point.

The point is that I noticed the discrepancy because it was an easy one to spot – there was only one transaction on my statement. But what happens when your monthly statement has pages and pages of transactions. Are you sure that you’re being credited with the points you’re entitled to?

I’m not suggesting you input fifty pages of spending into a spreadsheet every month just to check you’ve been credited with every mile and point due to you….but I am saying you should at least glance over what you’ve earned on your statements and see if it makes sense.

We’re not too bad about making sure we check that our miles and points balances are safe from the bad guys…but often we forget about the good guys. The good guys may not be out to defraud us but they can make mistakes so we shouldn’t forget to check what they’re up to too.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)