TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

There are increasingly more and more credit cards that don’t charge foreign transaction fees when you use them abroad, and that’s a trend that has been very good for those of us who like to travel. But when it comes to general everyday spending when you’re outside of the US, most of these cards don’t offer a great return. So which cards do?

I have a whole arsenal of cards I can use when traveling outside of the US, but most have one thing in common – they all earn me no more than 1.5 cents/dollar when I’m not spending in one of the popular bonus categories.

Here’s what some popular consumer credit cards (that don’t charge foreign transaction fees) offer for non-bonused spending:

- card_name – 1 point/dollar (my value = 1.5 cents).

- card_name – 1 point/dollar (my value = 1.5 cents).

- card_name – 1 point/dollar (my value = 1.5 cents)

- card_name – 1 point/dollar (my value = 1.5 cents).

- card_name – 3 points/dollar (my value = 1.2 cents).

- card_name – 3 points/dollar (my value = 1.2 cents).

- World of Hyatt credit card – 1 point/dollar (my value = 1.4 cents).

Clearly, the list above isn’t exhaustive, but it should give you an idea of what some of the more popular cards offer.

The fact is that, when I’m traveling abroad, I don’t just eat out and book travel (the two primary bonus categories that a lot of cards offer). I buy groceries, I shop, I visit museums, I go to sporting events, I go to the theatre, and I do a whole host of other things which when charged to most credit cards, would earn me a low effective rebate.

That’s not ideal, and as everyone should always be trying to maximize their earnings when they’re using their credit cards (whether at home or abroad), it’s important to make sure that you hold the cards that will do exactly that.

When you’re at home and in the US, that’s not difficult.

Cards like the Citi® Double Cash Card (review), card_name (review), and the card_name (review) will make sure that your earnings never fall below (by my valuation) 2.25% – 4.50% on spending in categories in which most other cards don’t offer a bonus. But these cards all charge foreign transaction fees, so what do you use when abroad?

My answer comes in the form of two cards – the card_name and the card_name.

card_name – a quick overview

The card_name charges a annual_fees annual fee and offers cardholders the following earning rates:

- 3 points/dollar on dining.

- 3 points/dollar at supermarkets/grocery stores.

- 3 points/dollar at gas stations.

- 3 points/dollar on airfares booked directly with airlines.

- 3 points/dollar on spending made directly with hotels.

- 1 point/dollar on all other eligible spending.

A few other cards will match most of what this card offers (although most will charge a higher annual fee), but for grocery spending and gas station spending outside of the US, the card_name cannot be beaten.

The card_name doesn’t charge foreign transaction fees and it doesn’t limit the enhanced earning rates that it offers to establishments in the US, and that’s how it overshadows cards like the card_name and the card_name.

As I value Citi ThankYou points at 1.5 cents each (based on the value that I know I can get out of them with minimal effort), this card offers me a 4.5% effective rebate on all grocery and gas station spending while I’m outside of the US, and that’s why it has a solid place in my wallet.

I appreciate, however, that a lot of people reading this article probably don’t spend large sums on gas and groceries while they’re abroad, and for them, the card_name probably wouldn’t be an essential part of their wallet.

But what about all of the other unbonused spending that people make when visiting new places?

For that spending, I suggest the card_name.

card_name – overview

Currently, the card_name comes with a annual_fees annual fee and offers cardholders the following earning rates:

- 5 miles/dollar on hotels and rental cars booked through Capital One Travel.

- 2 miles/dollar on all purchases with no cap.

It also gives cardholders 2 visits per year to Capital One and Plaza Premium lounges, and it’s a card that gives cardholders a Global Entry or TSA PreCheck credit every four years.

Most importantly, this card doesn’t charge foreign transaction fees.

Right now, this is the card’s welcome offer:

bonus_miles_full

I value Capital One miles at 1.5 cents each (based on how I use them), but even if we use a value as low as 1.0 cent/mile (which is what Capital One will give you for each mile), this card comes out as a winner for unbonused spending abroad.

A 2% rebate is what the best cash back cards offer us domestically, and the card_name gives cardholders that (as a minimum) when spending abroad.

How to get at least 1.0 cent out of every mile

In the world of Capital One, 1 mile is worth 1.0 cent towards all flight and hotel bookings made through the Venture Rewards portal, and while that may not make the currency particularly sexy, it does make it remarkably easy to use.

To redeem your miles, you simply sign in to your online Venture Rewards account and do one of two things – you either redeem miles as statement credits or you can book new travel.

Statement Credits: You can redeem miles (at a rate of 1 cent each) as a statement credit offsetting any eligible travel purchases made through the Capital One Venture Rewards card in the preceding 90 days (the definition of eligible travel covers airfares, hotel bookings, AirBnB, taxis/Uber/Lyft and more).

Book New Travel: You can use the Capital One travel portal to book flights and hotels with your miles (at a rate of 1 cent/mile) just as if you were using cash with any other travel portal. If you don’t have enough miles for your booking, you can use a credit card to make up any difference.

There are two great things about redeeming miles this way:

- You don’t have to face blackout dates and you don’t have to find award flights – you are simply booking a regular flight or room and using your miles/points as your currency of choice (rather than cash).

- You’ll earn miles/points/status credits on all the fights you book.

Chase Ultimate Rewards Points, Citi ThankYou points, and Amex Membership Rewards can be used in the same way, but none of those banks issues a credit card that will earn a cardholder at least 2% back on unbonused spending while abroad.

You can do better

For simplicity, you can’t do better than redeeming Capital One Miles for travel at a value of 1 cent/mile. If, however, you’re prepared to put in a bit of work, those miles can be worth more.

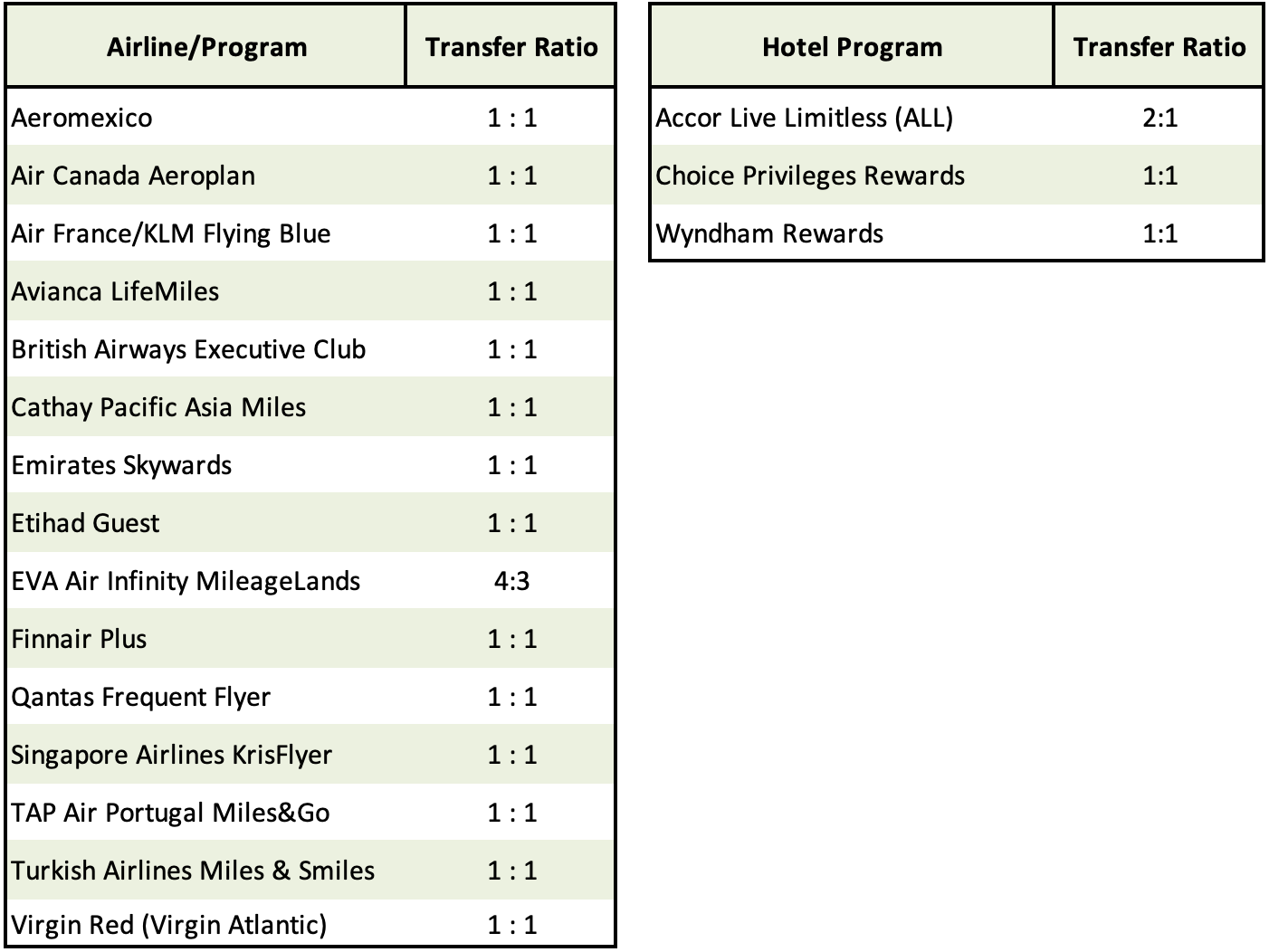

Capital One Miles can be transferred into a variety of points and miles in other loyalty programs …

… and it’s through these partners that great value can be extracted.

Yes, once your miles are transferred across to the likes of Cathay, Emirates, and Singapore Airlines, the search then begins for premium cabin award seats and that’s where patience and flexibility are required … but no one said this was easy 🙂

Personally, I get a lot of value from British Airways Avios which I use for short-haul flights within Europe and the US and on most occasions, I find myself getting over 2 cents out of each Avios I use (and therefore over 2 cents for every mile that I transfer across).

The value you can get out of Capital One Miles through transfers to partners will vary significantly depending on which partner the miles are transferred to and what kind of booking they’re being used for, so don’t expect to get a great return with ease or with every booking that you consider making. Your mileage will vary, as they say, but your mileage should be good.

Bottom line

We often focus on the bonus categories that a lot of the better credit cards offer without stopping to think what their base earnings are, and it’s the base earnings that we need to focus on when it comes to a lot of everyday spending that we do when we’re abroad.

A lot of the more popular cards don’t offer a great return on overseas spending that doesn’t fall into the travel or dining categories, so for me, the card_name is a must have card for grocery and gas spending outside of the US, and the card_name is the must have card for all other unbonused overseas spending.

What cards do you use when outside of the US?

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

Wells Fargo Autograph and Fidelity Rewards are 2% cashback cards no FTF. Discover Card charges no FTF and often will trigger any category bonuses even internationally, so you’ll get at least 1%. Why Amex often restricts bonus categories to US spend only is unclear.

My go to internationally is my Chase Sapphire Reserve. Main reason is I have found Amex is not accepted nearly as much as in the US outside of hotels and some retail shops. I already get 3X Ultimate Reward points on dining, tours, train/subway tickets and car rentals so frankly any other spend isn’t material to me or worth chasing with a different card.

Capital One Spark is 2% cash back with no FTF

Thanks for the very useful post. Citi premier and Diners Club make a nice pairing for me.